Cryptocurrencies

Imagine if keeping your car idling 24/7 produced solved Sudokus you could trade for heroin

September 6, 2016 — February 5, 2022

Suspiciously similar content

Bitcoins and ilk have thriving communities of tin-foil-hat-wearin’ and Ponzi-scheme types, and also some actual business models. Here we discuss some of them.

I run a one-person campaign to call enthusiasts for this tech cryptsters but it is not catching on. Or crypsters? Is that any easier?

Anyway, credit for the tagline on this page:

imagine if keeping your car idling 24/7 produced solved Sudokus you could trade for heroin

goes to @Theophite.

Notwithstanding the weirdness amongst many cryptsters, cryptocurrencies have practical use. For example, they are sometimes the cheapest way to get money across the border. This has been useful even for me, as a non-gun-smugglin’, non-heroin-usin’ guy who happens to move country sometimes, and doesn’t like paying a 5% conversion tithe between countries with weak banking ties, such as Australia and … anywhere which is not Australia. Crypto gets you that. In fact, last time I tried I accidentally got a -40% fee, because the value of the cryptocash increased while it was stuck in transit.

One could notionally do other useful things with cryptocurrencies, such as tip me for my work on this site. This practical use is currently not viable, though, because cryptocurrencies are so very much viewed as a capital investment rather than a medium of exchange, and you do not tip people with capital investments. This is exactly one of the problems, as Ranjan Roy argues:

Shouldn’t the whole crypto community not be rooting for prices to keep skyrocketing?

Astounding price appreciation is a death knell for becoming a medium of exchange. As long as people care about the price they’ll never engage with the utility. But the catch-22 is the price appreciation is all predicated on these digital things one—day becoming mediums of exchange.

Practically they have well-known deficiencies. For example, my exchange rate when buying cryptocurrency in Australia was terrible; I ended up paying about 8% on my last transfer after all the fees were deducted, which is worse than bank rates. My plain credit card came out better.

I am no expert in cryptocurrencies. Rather the opposite; my feeble intellect needs a n00b guide documenting the idiosyncrasies which trip me up and the weird terminology etc. This is that guide, or at least where I keep the links to the best guides. Cryptocurrencies have a vast number of hours of how-to guides; the difficulty is working out which ones are current and compensating for the marketing biases in each.

1 What?

A fun Bitcoin card game that will help spread adoption to the masses!

Kids and adults agree that SHAmory is the Bitcoin card game with the perfect mixture of fun and education for anyone interested in learning about Bitcoin. As a result, you will learn the basics of how mining works while earning Bitcoin rewards for each block you mine. Grab a friend and order your Bitcoin playing card game today!

2 Wallets

Esp. multicurrency.

3 Exchanges

How to convert cryptocurrency to/from cash? (cash: fiat currency, as one must learn to call it when talking to a cryptster):

Use an exchange.

Some mainstream options I have tried include

ChangeNOW, a web3 crypto thing which claims to allow one to use credit cards and also do quasi-unregulated crypto exchange.

FTXwent bust and took all my savings with it.bitstamp (referral link) is the one I have used most. It is reliable, but expensive to deposit to from Australia, only accepting SEPA and not the cheapest at 0.5% transaction fee.

Binance, which has pluses

(allows deposit in AUD)and minuses (glitchy website with unexplained errors which does not instill confidence in their professionalism), last time I tried to buy crypto with AUD my bank cancelled my credit card.Kinesis (referral link) offers metals as well as cryptocurrencies

localbitcoins facilitates peer-to-peer exchange and fiat/crypto exchange. I used them in the past for basic Forex when moving countries, but they do take large relative effort.

LocalMonero does the same for Monero.

NOW Wallet - best app for crypto assets by ChangeNOW

Store, buy, exchange and stake crypto in a secured mobile and desktop app. 40+ blockchains and thousands of tokens available.

I am not a lawyer or an accountant, so I do not know what the legal status of these services is, but I do know that the peer-to-peer options (e.g. localbitcoins) are substantially quicker and easier than the institutional ones like Binance. The latter which require so much ID and compliance overhead that they seem to be a part-time job in themselves. They also have a weird list of banned currencies.

Others I have had recommended include

- cointree vaunts their compliance with Australian law, but I have not tried for reasons I cannot remember

- Coinbase is the current dominant player as far as consumer-facing services AFAICT and supports a broad range of cryptocurrencies. They don’t seem that cheap.

- Metex - Crypto Friendly Exchange for Tokenized Metals

There are left-field options, built more upon decentralised blockchain-like systems themselves. One obvious one is bisq is a decentralised network for currency exchange. Openbazaar is a decentralised network for selling anything including currency.

I gather that there is a general push for Distributed Finance (“DeFi”) systems and so probably more of these p2p options will end up existing, and more of the existing mainstream centralised services will probably use that buzzword too.

4 Interesting financial instruments backed by cryptocurrency

I do not know if it is intrinsic to the idea of blockchains, or if it is just the newness of crypto that means that regulation has not caught up, but cryptocurrency has made many interesting financial instruments available to the public. From my own perspective, this is the most interesting thing about crypto, that even with the meagre capital I have, I can participate in schemes that would formerly have required me to be something much higher up the capitalism totem pole. To put it another way cryptocurrency has democratised predatory lending.

FWIW I think this is probably a good thing, in the long run, if society survives into the long run. There is no distinction between enough rope to climb something and enough rope to hang yourself; we need to learn how to use rope. I think it is better that we all have rope, not just the rope wholesalers. In the short run, realistically I think many people will get strangled before our rope skills are better. 1

Anyway, for now, the cryptocurrency world has served as an incredible directed evolution scheme for financial instruments, breeding new variants of Ponzi scheme and MLM robust against our traditional defences. Can we get to herd immunity from the most virulent variants?

4.1 Betting exchanges

4.2 Stablecoins

4.3 Tokenised stocks

4.4 NFTs

Some warm takes on 2021’s most irritating dinner table discussion after COVID.

- NFTs Were Supposed to Protect Artists. They Don’t.

- Applied Divinity Studies, Crypto is Stupid; Everything is Stupid; It’s All Okay

- How NFTs Create Value

- hic et nunc

- Getting Started with Tezos · hicetnunc Wiki

- Ian Bogost, The Sick, Refreshing Honesty of Web3: Let’s call things what they are: NFTs represent a first step in the securitization of digital assets. They turn digital data into speculative financial instruments. That shift has enormous implications because computers are in everything, and that makes anything a digital asset—your bank records, your Fitbit data, rings of your smart doorbell, a sentiment analysis of your work email, you name it. First the internet made it easy for people to conduct their lives online. Then it made it possible to monetize the attention generated by that online life. Now the digital exhaust of all that life online is poised to become an asset class for speculative investment, like stocks and commodities and mortgages.

5 Community

Classic: Jordan Pearson, Inside the World of the Bitcoin Carnivores

6 Flavours

6.1 Bitcoin

The classic and still the biggest in terms of hypothetical market cap.

Ten years in, nobody has come up with a use for blockchain

Bitcoin is what banking looked like in the middle ages— “here’s your libertarian paradise, have a nice day.”

That comparison may be subtler than the author intended.

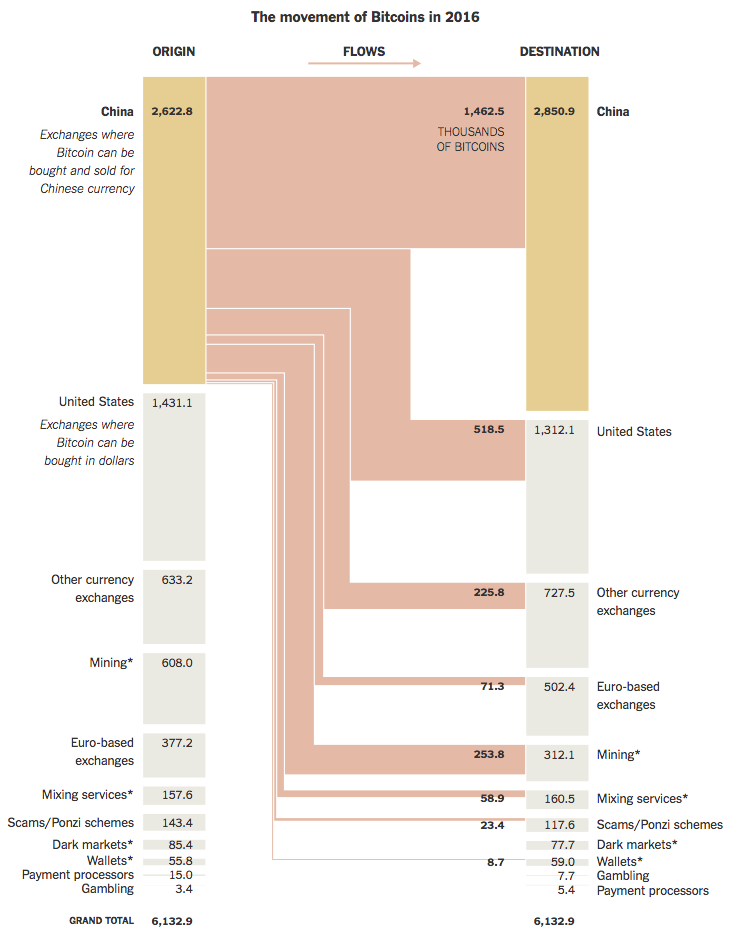

How China Took Center Stage in Bitcoin’s Civil War

Mr. Lee said the Chinese took quickly to Bitcoin for several reasons. For one thing, the Chinese government had strictly limited other potential investment avenues, giving citizens a hunger for new assets. Also, Mr. Lee said, the Chinese loved the volatile price of Bitcoin, which gave the fledgling currency network the feeling of online gambling, a very popular activity in China. […]

Peter Ng, a former investment manager, is one of the many people in China who moved from trading Bitcoins to amassing computing power to mine them. First, he mined for himself. More recently he has created data centres across China where other people can pay to set up their own mining computers. He now has 28 such centres, all of them filled with endless racks of servers, tangled cords and fans cooling the machines.

Mr. Ng, 36, said he had become an expert in finding cheap energy, often in places where a coal plant or hydroelectric dam was built to support some industrial project that never happened. The Bitcoin mining machines in his facilities use about 38 megawatts of electricity, he said, enough to power a small city.

6.2 Ethereum

A kind of infrastructural one upon which others are built. TBD.

6.3 Monero

Unlike bitcoin, seems to be oriented toward anonymity, which bitcoin is not especially good at apparently. I’m not sure that is what I need right now. Does it have other useful features? Can you even trade it as a normal person or is it only for drug dealers and dissidents?

6.4 Ripple

Ripple is a (distributed?) ledger designed for cross-currency remittances, apparently. Once again it seems like this should be good for low-fee international transactions but I cannot seem to make that fly without a bank account in each country.

6.5 Stellar Lumens

I don’t know anything about Stellar and their Lumens except for their flashy launch. Something something easy conversion something?

6.6 Zcash

🏗

6.7 Decred

Decred is an open and progressive cryptocurrency with a system of community-based governance integrated into its blockchain.

🏗

6.8 USDC etc

TBC

6.9 Others

Most blockchain mechanisms have a cryptocurrency buried somewhere in them.

7 Incoming

- Estimated costs of 51% attacks on various cryptocurrencies.

- Chris Mountford, a.k.a Blockzombie is a fun guy to follow on these themes.

- China launches national blockchain.

- PJ Vogt, Selling Drugs to Buy Crypto

- The Ultimate Crypto Wallet for DeFi, Web3 Apps, and NFTs | MetaMask

- Brave Wallet

- A from-scratch tour of Bitcoin in Python

- An introduction to the Cardano blockchain

- Cardano chain | DappRadar

- Uniswap Review: Decentralised Trading Protocol - Coin Bureau

- Serum Protocol: Solana DeFi Solution you NEED to Explore

- Minswap DEX | Multi-pool decentralised exchange on Cardano

8 References

Footnotes

Democratizing science probably has a similar problem; I think we will get more noise and overemphasises conspiracy-theory from that before we work out how to really integrate new members into the community of science.↩︎